Understanding the General Electric (GE) Model: A Strategic Analysis Framework

Introduction:

Components of the GE Model:

Market Attractiveness:

- Market Size: The size of the market segment and its growth potential.

- Market Growth Rate: The rate at which the market is expanding.

- Market Profitability: The potential profitability of the market segment.

- Competitive Intensity: The level of competition within the market.

Business Unit Strength:

- Competitive Position: The business unit's market share and competitive advantage.

- Strength of Assets and Capabilities: The resources and capabilities of the business unit.

- Industry Attractiveness: The attractiveness of the industry in which the business unit operates.

- Profitability: The current and potential profitability of the business unit.

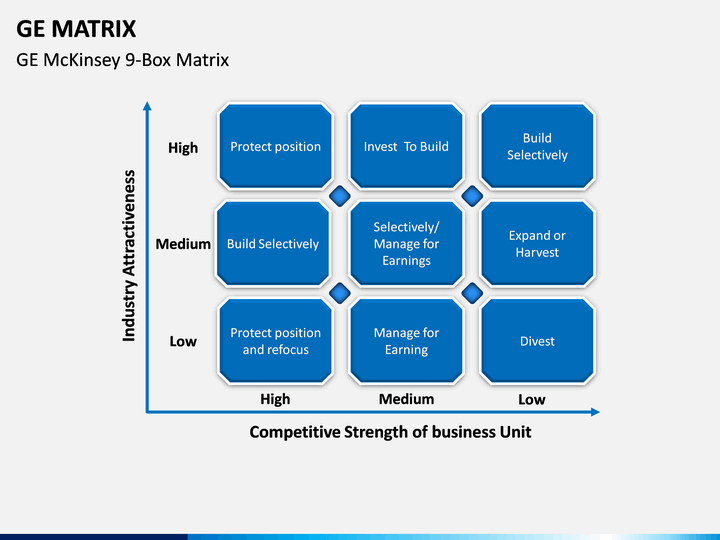

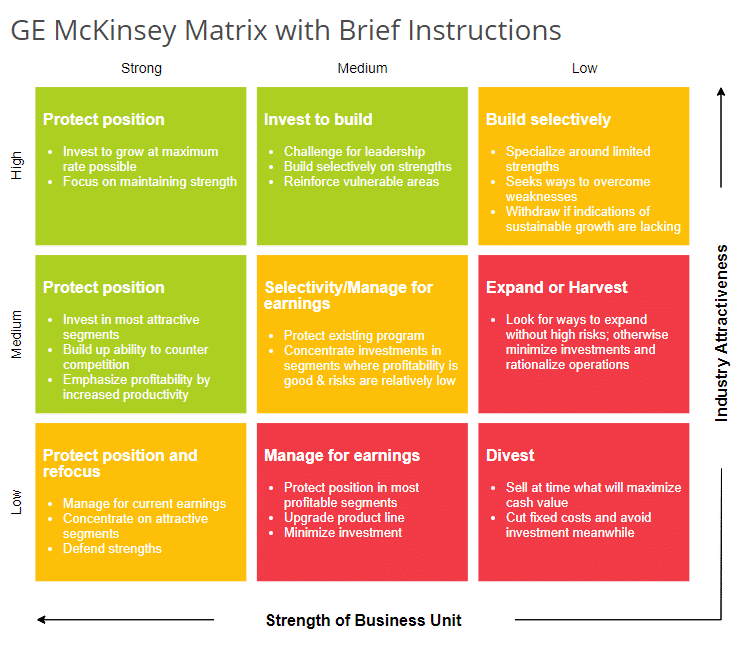

Description of the GE Model

The Green Zone consists of the three cells in the upper left corner. If your enterprise falls in this zone you are in a favorable position with relatively attractive growth opportunities. This indicates a "green light" to invest in this product/service.

The Yellow Zone consists of the three diagonal cells from the lower left to the upper right. A position in the yellow zone is viewed as having medium attractiveness. Management must therefore exercise caution when making additional investments in this product/service. The suggested strategy is to seek to maintain share rather than growing or reducing share.

The Red Zone consists of the three cells in the lower right corner. A

position in the red zone is not attractive. The suggested strategy is that

management should begin to make plans to exit the industry.

Doing What is Required to Be Done.

Green: Invest

Yellow: Protect

Red : Harvest

Example from the Industry:

Let's consider the automobile industry and apply the GE Model to assess the performance of different car models offered by a hypothetical automobile company.

Market Attractiveness:

- Market Size: The SUV market segment is large and growing due to consumer demand for spacious and versatile vehicles.

- Market Growth Rate: The SUV segment is experiencing rapid growth compared to other segments.

- Market Profitability: SUVs tend to have higher profit margins compared to smaller car segments.

- Competitive Intensity: The SUV market is highly competitive, with several established players and new entrants.

Business Unit Strength:

- Competitive Position: The company's flagship SUV model holds a significant market share and enjoys brand recognition.

- Strength of Assets and Capabilities: The company has a strong reputation for manufacturing reliable and durable vehicles.

- Industry Attractiveness: The overall automobile industry is experiencing moderate growth and profitability.

- Profitability: The SUV business unit generates substantial profits for the company due to high demand and favorable margins.

Conclusion:

Comments

Post a Comment